A Mixed Bag

This Tuesday, the DC Council held its first vote on the FY18 budget. While a more complete analysis will take time, I will report for now on those matters addressed directly in the DC4D budget resolution passed on May 9th, on which we based our Open Letter to the DC Council. The FY18 Budget turns out to be a mixed bag, just like the Councilmembers who voted on it.

The Pluses

On the plus side of the ledger, we celebrate: 1) funding for repairing public housing ($19 million according to the Fair Budget Coalition), 2) almost full funding for the Neighborhood Engagement Achieves Results (NEAR) Act, with $2 million for the Office of Neighborhood Safety and Engagement, and 3) full funding for start-up costs for Paid Family Leave.

The Minuses

The Council failed to adequately fund even the band-aid responses to the crisis of homelessness and affordable housing. Rental assistance was not meaningfully expanded, the Housing Production Trust Fund (HPTF) funding remained flat, and we are not on track to end chronic homelessness, as promised. The Council has failed to provide leadership on the Number 1 issue for our members and the public at large. And while Paid Family Leave is funded, its future is uncertain, given the Chairman’s willingness to entertain alternatives favored by Big Business.

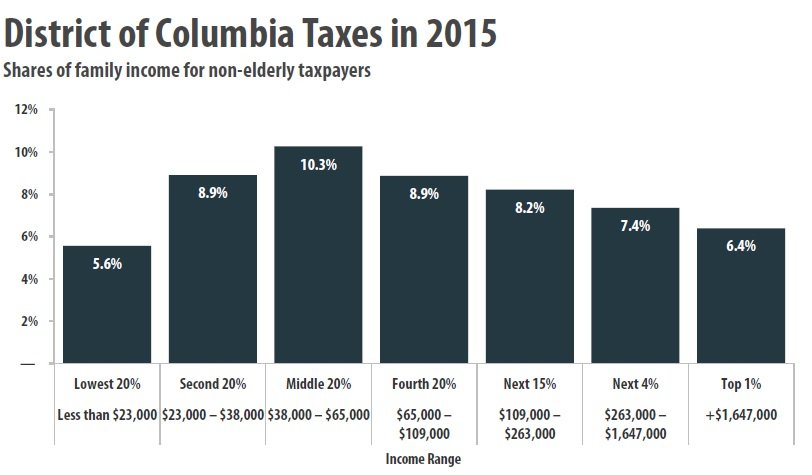

Source (Institute on Taxation & Economic Policy)

The Council voted to continue a pattern of cutting estate taxes and business taxes, despite the fact that DC does NOT have a progressive tax structure (as the above graphic shows). Councilmember Grosso proposed two amendments: 1) an amendment to delay the estate tax cut, which was supported by Councilmembers Nadeau, Silverman, and T. White, and 2) an amendment to limit the business tax cut for firms earning less than $10 million, which was supported by Councilmembers Nadeau and Silverman. Both amendments were defeated by a super-majority of the Council. Arguments for the amendments were published by Councilmembers Grosso and Silverman, while arguments against were published by Councilmember R. White. I encourage you to read these arguments, as they are revealing, and to thank those Councilmembers who voted the right way.

The Takeaway

The votes on the tax cut amendments demonstrate that a super-majority of the Council are out of step with the public on the vital matters of revenue and spending. What can explain such a “democracy deficit?” One factor is the power of Big Business and the Federal City Council, which engineered the current model of economic development since the 1990s, and whose CEO, Mayor Tony Williams, chaired the Tax Revision Commission whose recommendations were largely adopted by the Council.

We are heartened that a handful of Councilmembers stood squarely with the people on both amendments. We are dismayed by the votes of the rest of the Council, and in particular by the votes of Councilmembers Allen, McDuffie, and R. White, for whom we actively campaigned. Tuesday was a wake-up call to the sobering reality that while the current Council supports some significant progressive reforms, we cannot rely on them to consistently represent our values. We will need to redouble our efforts, in concert with our progressive allies, to make the DC Council more accountable to the people of DC.